Customs Information

Important information for sending parcels or pallets outside EU.

Customs documents

In case of parcels or pallets shipped outside the EU, in addition to the shipping document a commercial invoice or a proforma invoice accompanying the goods is required. A copy of the invoice must be sent by e-mail to tullaus.fi@postnord.com and the original invoices should be attached in a plastic folder to the shipment. A extra charce of the missing invoice will be charged according the surcharge price list. The original invoices must be drawn up in English, in at least three copies and signed by hand. (If the company is an appreoved exporter by the Customs, this is not required.)

Please note that there are areas inside EU that don't belong to the EU's tax territory. To these destinations you need commercial invoice or proforma invoice:

- Spain: the Canary Islands, Ceuta and Melilla

- Italy: San Marino and the Vatican

- Denmark: the Faroe Islands and Greenland (only postal shipments).

Mypack Collect shipments to Norway

Mypack Collect can be used from non-EU countries only to Norway, and

the consignment must be at least 20 parcels. The invoice should be issued to a single buyer (company) in Norway (for more information, please refer to the Split Shipment). To ensure a smooth delivery, please contact our

sales in good time before sending the first batch.

Shipments to Åland

The declaration of VAT on imports in the case of shipments over the Åland Islands has changed since the beginning of 2018. For more information on the shipments between Åland and mainland Finland see Tax Administration's web pages.

Shipments to the UK

Please note! Deliveries to the UK have been suspended for the time being. The reason for the suspension is the ever-changing import requirements of the UK's departure from the EU and the difficulties associated with them.

In addition to a commercial or pro forma invoice, an Importer Information form and a Direct Representation form are required for pallet shipments to the UK. The completed forms and a copy of the invoice must be sent by e-mail to our customs department at tullaus.fi@postnord.com.

Click here for instructions on shipping a pallet and filling out the Importer Information form.

Commercial invoice – for goods intended for sale

A commercial invoice is issued in three copies in English, and signed manually. The commercial invoice must have the following information:

- Precise address information and contact persons of the sender and the recipient

- EORI number*

- Recipients Business ID corresponding to "Registration Number", or in the case of a private individual his social security number. (In Norway, the so-called "PID Number" is required when the item's value is NOK 1 000 or more.)

- Billing address

- Invoice number and date

- Tracking number or consignment note number

- Terms of delivery

- Package content / exact description of the goods by using the actual trade name

- Weight (gross and net)

- Volume of the parcels or pallets

- Currency

- CN-nomenclature and export limits term and additional codes

- Certificate of origin

Proforma invoice – for gifts, samples and documents

You can use a proforma invoice instead of a commercial invoice when you do not charge the recipient any payment for the goods. The same instructions as in commercial invoice apply also to proforma invoice. The proforma invoice must in addition state the reason why the goods are free of charge, e.g. samples, repair under warranty, exhibition goods. Please note however that a nominal value of the goods must be stated on the invoice and it cannot be 0.

You can use this proforma invoice template as a guideline.

Packing list – a document that itemizes the item details of the shipment

The packing list is not obligatory but it is useful as it itemizes such details as the total number of items in the shipment, the weight, the volume, the parcel numbers, and product-specific information such as colours, size numbers, etc. The consignment note is attached to item no. 1.

Split shipment/invoice (only possible when sending to Norway)

Multiple consignments can be used to send freight parcels to one recipient on a single commercia or proformal invoice. The invoicing address must be a VAT registered company in the country of destination. Therefore, no actual shipping addresses will be on the invoice. Otherwise the same invoicing information is required as for a commercial or proforal invoice.

In addition to the invoice, the consignment must also be accompanied by a shipping list (eg excel list)containing only PostNord tracking number,

recipient and shipping address. The shipping list is attached to the parcel/pallet number 1.The signed invoices must be accompanied by three copies and a shipping list. A copy of the invoice and shipping list must be emailed to tullaus.fi@postnord.com.

Letter of authorisation to export shipments to the Serbia and Bosnia-Herzegovina

For export shipments, the recipient is responsible for possible import customs fees and taxes. Before the parcel may be delivered to the recipient, some destination countries require a letter of authorisation (Power of Attorney) from the recipient, to guarantee that they are liable to pay possible import costs. As a sender, you can ensure fast deliveries by requesting the recipient to complete this letter of authorisation beforehand.

Letter of authorisation for a recipient in Serbia or Bosnia-Herzegovina

EUR.1 movement certificate (certificate of origin)

The origin of the goods is indicated with a EUR.1 movement certificate or an exporter declaration. EUR.1 movement certificate (certificate of origin) from the export country's customs must be requested for all original products. The certificate must be authenticated by customs. The exporters must complete the application section of the certificate and provide it with the customs stamp from the nearest customs office. The origin of the product is declared with this certificate of origin in the destination country in order to obtain preferential treatment.

Exporter declaration (commercial invoice declaration)

Each exporter is entitled to draw up a commercial invoice declaration for original products if the value of the exported original products does not exceed EUR 6 000 (standard situation). An authorised exporter can instead draw up commercial invoice declarations regardless of the value of the shipment. A company exporting original products regularly can apply to become an authorised exporter.

*EORI number

EORI numbers are unique European Community numbers given by the customs authorities of Member States to companies. When registering in a Member State, a company receives an EORI number that must be used in all Member States in connection with customs clearance. In Finland, the business ID in the form FI1234567-8 is used as the EORI number. You can apply for an EORI number at Finnish Customs.

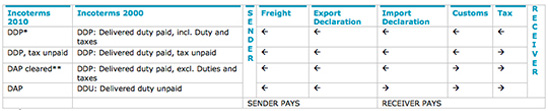

Incoterms – terms of delivery

The Incoterms clauses define the seller and buyer's responsibilities concerning the deliveries, goods and costs. When exporting to countries outside the EU, you must ensure that the commercial invoice states, in connection with the delivery terms, whether the Incoterms 2000 or Incoterms 2010-based delivery clauses are used.

The terms of delivery from the chart below can be applied with PostNord Parcel service. PostNord MyPack Collect and PostNord Pallet shipments are delivered only in accordance with the DAP delivery terms whereby the recipient is always responsible for the import customs duty.

*! Note: The DAP delivery chain clauses must state the place of delivery, e.g. DAP, Street 1, CH-1234 Zürich.

Shipments to Finland

For customs purposes, "import" means bringing goods to Finland from a country outside the EU. The goods must be cleared before they can be used or resold. The most common customs import clearance method is the release of goods for free circulation and consumption. This method requires a customs declaration.

Taxes and payments

The taxes and payments are levied depend on the goods, tariff lines, origin and customs value. The most often levied taxes when importing are the customs duties and VAT. When importing goods from outside the EU, a so-called third country duty is levied. This customs duty based on the tariff is applied to all goods arriving from third countries, unless preferential treatment, tariff quotas or duty suspensions reduce or eliminate such duties.

Further information

Further information is available on the Finnish Customs' website www.tulli.fi.

PostNord customer service will also help you:

email: tullaus.fi@postnord.com